Spencer Platt/Getty Images

- Avis stock's short-squeeze on Tuesday prompted JPMorgan to re-evaluate its risk/reward profile.

- JPMorgan double-downgraded Avis to "Underweight" in a Wednesday note despite its strong fundamentals.

- "Significantly raise price target to $225 but still see downside to now much higher share price," JPMorgan said.

A short-squeeze in Avis Budget Group on Tuesday sent shares of the car rental company soaring as much as 217%, but the gains are not sustainable, according to JPMorgan.

The bank issued a double downgrade for Avis stock to Underweight from Overweight as Tuesday's rally was too far too fast, according to a Wednesday note.

JPMorgan was more than encouraged by Avis' strong third-quarter earnings results, raising its price target to $225 from $100. But with Avis closing above $350 on Tuesday, the stock is still subject to potential near-term downside of 37%.

"While we had only recently upgraded Avis shares to Overweight and fundamentals are the strongest they have ever been, the unprecedented run-up in Avis shares prompt our downgrade to Underweight, including given the consideration that the shares may have risen in part for technical reasons apart from the fundamentals, suggesting the potential to normalize lower over the short term," JPMorgan explained.

The bank said that there's a lot to like about Avis, and that part of yesterday's gain was warranted.

Recent positive developments for Avis include a much faster recovery from the pandemic than expected, higher used car resale values, a larger-than-expected stock buyback program, and the company's plan to add more electric vehicles to its line up.

All of those positives "likely collided with a high short interest and a free float limited by both the lower shares outstanding and significant long-term ownership effectively not in the free float to prompt a 'short squeeze,'" JPMorgan said.

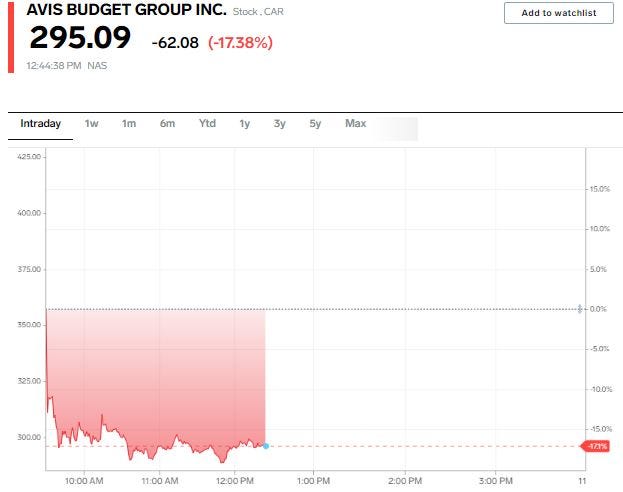

Avis stock fell as much as 19% in Wednesday's trading session, but is still up nearly 700% year-to-date.